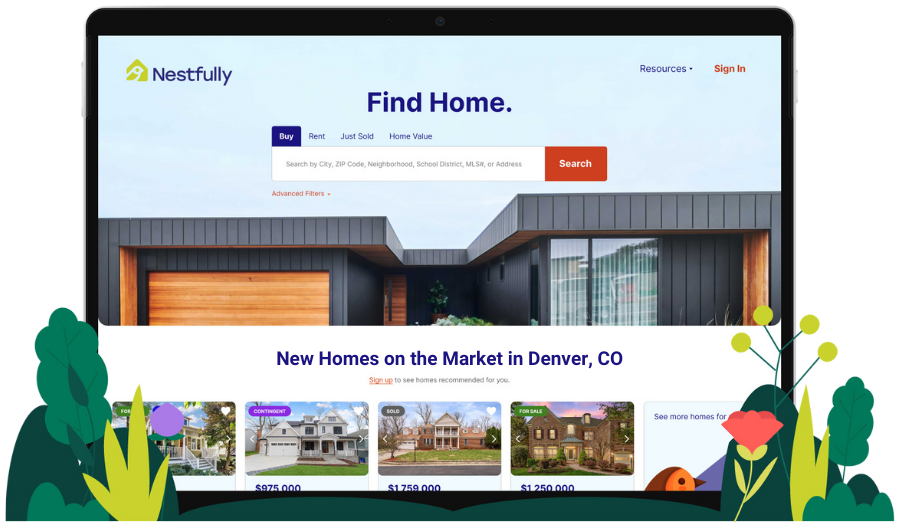

Discover the Nestfully Home Search Site

The future of real estate is here! REcolorado has partnered with Nestfully to change the game for homebuyers, sellers, and renters everywhere. How? Nestfully opens the door to the REcolorado MLS—the same source of complete and accurate listing information that the pros use—and invites you to explore.